|

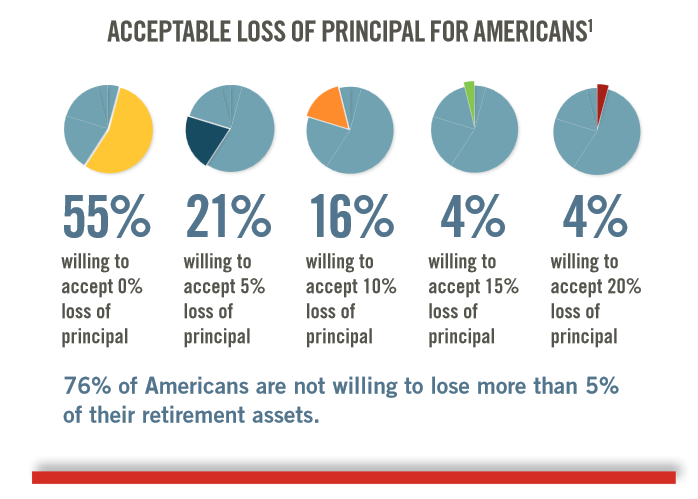

While title of this post "Acceptable Loss" sounds like a giant oxymoron similar to "rolling-stop" or "half-dead" I can assure you there is true meaning behind it. Recently I was looking over an article published by WealthVest that talked about the top three fears among retirees that they surveyed. These three fears were: Investment risk, Longevity risk, and Market valuations. Looking at the first which is the most intuitive: Investment risk. Over the past 15 years traditional investors have battled with two severe bear markets. Its no wonder after suffering from a 50% haircut in your account value (twice) that people would be a little hesitant to take on unneeded investment risk. Statistically speaking 77% of Americans are less comfortable with investment risk today than they were 10 years ago, according to the WealthVest survey. Look at the graphic below as it relates to per-retirees and active retirees tolerance for loss. To clarify in this example we are talking about decline in portfolio value, which doesn't specifically mean a realized loss from selling. Using the data above, a whopping 76% of these survey respondents are unwilling to accept anything more than 5% of their portfolio principal. A typical market correction is traditionally defined as a stock market decline of 10% or more. Since 1950 the US stock market has averaged an annual decline of approximately 14. 2% each and every year. (Source: JPMorgan Guide to the Markets)

Folks if you are concerned about these types of fluctuations then you will need to seriously evaluate how much equity you have in the portfolio. There are a large amount of stocks that move more than that in just a few trading days. Additionally if you have a large allocation to bonds, you may see similar declines when and if interest rates start to rise. These scenarios set investors up for inefficient portfolio allocations and performance return expectations. Risk and reward are directly related. More risk can sometimes offer more reward, but this is not always the case, and of course nothing is a guarantee. Sometimes you take more risk owning a large amount of stocks and instead of getting more return your suffer large losses. That is the "risk" part. To conclude, what is your Acceptable Loss number. And does your current strategy align with that number realistically....? |

by Tim Dyer

Let us know what you would like to learn more about and we will review it! Archives

September 2017

Categories |

Dyer Wealth Management

|

Company |

Support

|

This website is solely for informational purposes. Dyer Wealth Management provides advisory services through Sage Capital Advisors, LLC., an SEC Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where representatives of Dyer Wealth Management are properly licensed or exempt from licensure. No advice may be rendered unless a client service agreement is in place. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. ”

* J. Timothy Dyer provides insurance products and services including life insurance and annuities. Insurance transactions do not fall under the advisory services outlined in the Dyer Wealth Management investment management. Additionally insurance transactions are not affiliated with Sage Capital Advisors and may contain commissions paid to agent.

* J. Timothy Dyer provides insurance products and services including life insurance and annuities. Insurance transactions do not fall under the advisory services outlined in the Dyer Wealth Management investment management. Additionally insurance transactions are not affiliated with Sage Capital Advisors and may contain commissions paid to agent.

© COPYRIGHT 2019. ALL RIGHTS RESERVED.

RSS Feed

RSS Feed

9/14/2017

1 Comment