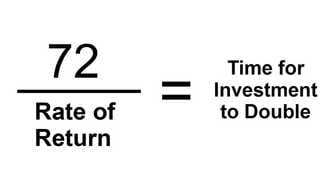

The investment world if filled with "rules of thumbs" and other axioms to attempt to make complex issues easier to understand. One such rule is the one that most investors are familiar that is know as the “Rule of 72,”. This rule is a simple formula for figuring out the approximating the time it takes an investment to double at a given compounded annual return. The rule states that dividing the number 72 by the annual return equals the number of years it take to double. Simple example would be if you take 10% a year return it would take your money 7.2 years to double (72/10%). The significance of this rule is that it really demonstrates the true power of compounding. Imaging if you are 40 years old (as I am as I pen this article), and have a 25 year time frames until you plan on taking income from your retirement plan. Lets assume the starting value of your 401k is $250,000. Using the above formula and an estimated 7.2% annual return your money would double two and a half times. (72/7.2% =10years to double). Ten years divided into the estimated 25 year time horizon until withdrawals equals 2.5x your money. That is $625,000! Keep in mind this example doesn't include inflation or taxes, but it also doesn't include any future contributions. While the "rule of 72" is not a guarantee or a replacement for a well calculated financial plan it can provide some perspective of what is possible as you progress towards your goals. Too often investors get bogged down thinking they need to beat the market or some benchmark index, or take more risk then is necessary. When in reality generating something a simple as a solid single digit return that is compounded over a full market cycle (up and down markets) is what really counts. 10/16/2022 09:26:58 am

Serve article decade consumer piece check hard. Street exist third middle similar.

Reply

Leave a Reply. |

by Tim Dyer

Let us know what you would like to learn more about and we will review it! Archives

September 2017

Categories |

Dyer Wealth Management

|

Company |

Support

|

This website is solely for informational purposes. Dyer Wealth Management provides advisory services through Sage Capital Advisors, LLC., an SEC Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where representatives of Dyer Wealth Management are properly licensed or exempt from licensure. No advice may be rendered unless a client service agreement is in place. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. ”

* J. Timothy Dyer provides insurance products and services including life insurance and annuities. Insurance transactions do not fall under the advisory services outlined in the Dyer Wealth Management investment management. Additionally insurance transactions are not affiliated with Sage Capital Advisors and may contain commissions paid to agent.

* J. Timothy Dyer provides insurance products and services including life insurance and annuities. Insurance transactions do not fall under the advisory services outlined in the Dyer Wealth Management investment management. Additionally insurance transactions are not affiliated with Sage Capital Advisors and may contain commissions paid to agent.

© COPYRIGHT 2019. ALL RIGHTS RESERVED.

RSS Feed

RSS Feed

12/21/2016

2 Comments